Mortgage Rates Today: Seizing the Moment for Your 30-Year Fixed and Refinance Journey

Alright everyone, let's talk about something truly exciting. I know, I know, "mortgage rates" don't exactly scream "thrill ride." But trust me on this one. We're seeing some movement that could be a game-changer for anyone dreaming of owning a home, or even just getting a better handle on their finances.

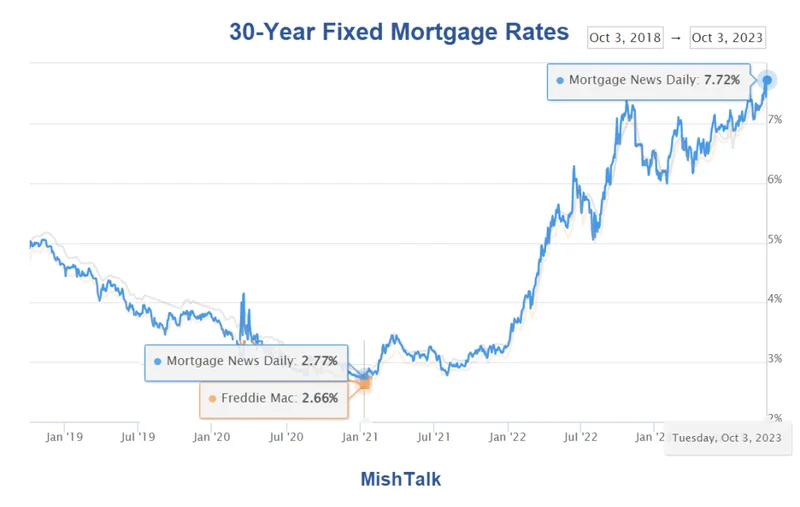

The news is this: [mortgage interest rates] are flirting with their lowest levels of the year. We're talking about the average 30-year fixed rate dipping to around 6.06%, matching a low we saw briefly back in October. Now, before you say "Aris, 6% is still high!", let's put this into perspective. We've been stuck in a high-rate environment for what feels like forever, and this little dip could be the start of something much bigger.

The Great Affordability Thaw

Think of it like this: imagine you're trying to push a car up a hill. That hill represents the cost of buying a home – the down payment, the closing costs, and, of course, those [mortgage interest rates]. For the past couple of years, that hill has been practically vertical. But now? Now the slope is easing, just a little bit, but enough to make a real difference.

And it’s not just about that headline 30-year rate. We're also seeing movement in other areas, like 15-year fixed rates (dipping to around 5.53%) and even some of the adjustable-rate mortgages. It's a broad trend, suggesting a real shift in the market. This isn't just a blip; this is a potential sea change.

Now, I know what some of you are thinking: "Yeah, but what about the Fed? What about inflation? What about [President] Trump’s tariffs?!" And those are all valid concerns. The economic landscape is still uncertain, that's definitely true. As Sam Williamson, senior economist at First American, put it, “Uncertainty ahead of the Federal Open Market Committee’s December meeting... could result in short-term volatility in [mortgage rates] as more data comes in and policymakers wait for a clearer read on the economy.”

But here's the thing: the market anticipates. The Fed has already made two rate cuts this year, and there's a strong possibility of another one in December. The CME FedWatch tool, for example, is predicting an 85% chance of yet another quarter-point cut. That's not a guarantee, of course, but it's a strong signal that the overall trend is downward.

What does this mean for you? It means that if you've been sitting on the sidelines, waiting for the right moment to buy or refinance, that moment might be closer than you think. I mean, seriously, think about it: a slightly lower rate can translate into tens of thousands of dollars saved over the life of a loan. That's money you could use for renovations, for your kids' education, or just for a little bit of extra financial security.

And speaking of refinancing, this could be a golden opportunity for homeowners who bought in the past year or two, when rates were significantly higher. Even a half-percentage point drop can make a real difference in your monthly payments. It's like getting a raise without having to ask your boss!

Of course, there are costs associated with refinancing – appraisal fees, title searches, all that fun stuff. But if you do your homework and shop around for the best rates and terms, the savings can easily outweigh the costs. It's like investing in your own future financial well-being.

Here's a crucial point to remember: this isn't just about numbers and percentages. This is about dreams. This is about families finding a place to call home. This is about building wealth and creating a secure future. And that's something worth getting excited about.

But, of course, with every technological or financial advance, there's always a consideration of responsibility. We need to ensure that these lower rates don't lead to another housing bubble, that lenders are responsible in their lending practices, and that everyone has access to fair and transparent information.

This is Just the Beginning

So, where do we go from here? Well, economists are predicting that mortgage rates will continue to ease a bit lower in 2026. Fannie Mae, for example, is forecasting a 30-year fixed rate of 5.9% by the end of 2026. The Mortgage Bankers Association is a bit more conservative, predicting rates to hold steady around 6.4%. But either way, the overall trend is toward lower rates and greater affordability. Mortgage and refinance interest rates today, November 25, 2025: Lowest 30-year rate this year

And that, my friends, is something to celebrate.