Post-Crash DeFi: 2025 Data's Surprising Dichotomy - Deep Dive Discussion

2025-12-03 02:12:165

DeFi's Crash Aftermath: Value or Just Less Bad?

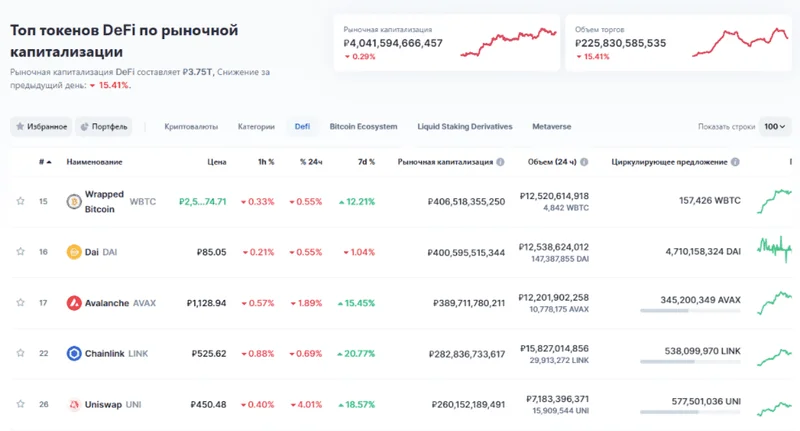

DeFi's Post-Crash Reality: Discounted Prices, Not Necessarily a Fire Sale The DeFi sector is still reeling from the October 10th crash, and the latest data paints a mixed picture. FalconX's report, dated November 20, 2025, indicates that only 2 out of 23 leading DeFi tokens are in positive territory year-to-date. That’s a dismal 9% success rate. The group is down 37% on average for the quarter-to-date, a clear sign of extended sell-offs. But, before you start loading up on what looks like discounted crypto, let’s dig a little deeper. Investor behavior suggests a flight to safety, or at least the *perception* of safety. Tokens with buyback programs, like HYPE (down 16% QTD) and CAKE (down 12% QTD), have outperformed. Lending names such as MORPHO (down 1%) and SYRUP (down 13%) also saw relative outperformance, attributed to specific catalysts, like limited exposure to the Stream Finance debacle. It's not necessarily *good* performance, mind you, just *less bad*. Are investors genuinely discerning value, or simply piling into anything that hints at stability in a volatile market? Shifting valuations are another key indicator. Spot and perpetual decentralized exchanges (DEXes) have seen their price-to-sales multiples compress. This means prices have fallen faster than protocol activity. Some DEXes, including CRV, RUNE, and CAKE, actually posted higher 30-day fees as of November 20 compared to September 30. This divergence – lower prices, higher fees – might suggest a buying opportunity, *if* you believe in the long-term viability of these specific DEXes. The question is, will this translate to actual revenue and profit? Lending and yield names, on the other hand, have broadly *steepened* on a multiples basis. Prices haven't fallen as much as fees. KMNO, for example, saw its market cap decline 13%, while fees plummeted 34%. This could mean investors are piling into lending, viewing it as a safer haven during the downturn. Lending activity *might* even increase as investors flee to stablecoins and seek yield. But that is still a big "might."DeFi "Leadership": Selection Bias or Genuine Value?

Beyond the Headlines: Questioning the Data Here's where I start to get skeptical. The FalconX report focuses on a "subsect of 23 leading DeFi names." But what *defines* a "leading" DeFi name? And how were these 23 selected? The report doesn't say (or at least, the provided excerpts don't). This selection bias could skew the entire analysis. If the sample is not representative, the conclusions become less reliable. And this is the part of the report that I find genuinely puzzling. The report mentions that "investors expect perps to continue to lead," citing HYPE's outperformance and "investor optimism around its ‘perps on anything’ HIP-3 markets." But is that optimism justified? Or is it simply a case of recency bias, amplified by social media hype? The broader trend suggests prediction markets are seeing record volumes. Are investors placing bets on "perps on anything", or is it just being driven by the "perps" narrative? Consider the "vibe check" provided by Andy Baehr of CoinDesk Indices. He notes "sentiment is max negative," but then asks, "was there enough grief, or is this another false bottom? Did capitulation occur?". He quotes Eric Peters who reminds us that "Investors who blow up and lose everything tend to believe that they know exactly why a market should be moving." This aligns with my skepticism of narratives. As Baehr notes in The Striking Dichotomy in DeFi Tokens Post 10, it's difficult to gauge true market sentiment. So, What's the Real Story? It's a qualified "maybe." The DeFi sector is undoubtedly cheaper than it was before the October crash. But cheaper doesn't automatically equal "good value." Investor behavior suggests a preference for perceived safety and names with potential catalysts. But, before you jump in, scrutinize *why* those names are outperforming. Are they fundamentally stronger, or are they just benefiting from short-term market dynamics and clever marketing? The data is useful, but it requires a healthy dose of skepticism—the kind that stops you from mistaking a discount for a deal.