Mortgage Rates Today: Unlocking the Future of Your 30-Year & Refinance Options

Title: Mortgage Rates Dip? It's a Launchpad to the Future of Homeownership!

Okay, folks, let's talk about something that might seem a little dry on the surface: mortgage rates. I know, I know, it's not exactly the stuff of science fiction. But stick with me, because what's happening with mortgage rates right now is a tiny glimpse into a much bigger, much more exciting picture.

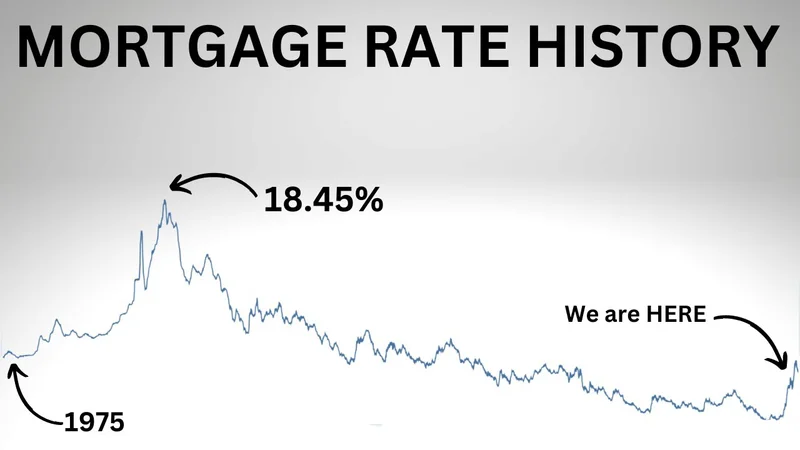

According to the latest reports, we're seeing a slight dip in mortgage rates. Freddie Mac says the average 30-year fixed rate is down a bit, and Zillow's showing similar trends. On the surface, that's… well, it's good news if you're looking to buy a house. But what if it's more than that? What if it's a sign of a fundamental shift in how we think about homeownership, finance, and even community?

A Foundation for Tomorrow

See, I don't just look at numbers; I look at trends, at the underlying currents that are shaping our world. And what I see right now is a convergence of factors that could make homeownership more accessible, more sustainable, and more integrated into our lives than ever before.

Let's break it down. Interest rates have been fluctuating, but there's a general move lower. Experts at Fannie Mae and the Mortgage Bankers Association are forecasting rates to stay relatively stable, maybe even dip a little further, over the next year. And while I take those predictions with a grain of salt – remember, even the best models are just educated guesses – the overall direction is promising. For example, Mortgage Rates Drop Before Thanksgiving | Today, November 26, 2025 shows a similar downward trend.

But what does this mean for you? Imagine a world where owning a home isn't a crushing burden, but a springboard to other opportunities. Lower mortgage rates mean more disposable income, which can be reinvested in education, entrepreneurship, or simply enjoying life. It means families have more financial flexibility to pursue their dreams.

And it's not just about individual finances. Accessible homeownership can strengthen communities, foster stability, and create a sense of belonging. When people have a stake in their neighborhoods, they're more likely to invest in their future, to get involved in local initiatives, to build relationships with their neighbors. It's a virtuous cycle that can transform society from the ground up.

Think about the implications for urban planning. With more affordable mortgages, we could see a resurgence of vibrant, mixed-income neighborhoods, where people from all walks of life live side-by-side. We could see a decrease in urban sprawl as people choose to invest in existing communities rather than sprawling suburbs.

Now, I know what some of you are thinking: "Aris, you're getting carried away. It's just a small dip in mortgage rates!" And you're right, it's not a magic bullet. There are still plenty of challenges to overcome, from income inequality to housing shortages. But every great transformation starts with a single step, and this could be one of those steps.

Consider this: the rise of the printing press didn't instantly create a literate society, but it laid the foundation for the democratization of knowledge. Similarly, a dip in mortgage rates might not instantly solve all our housing problems, but it can create the conditions for a more equitable and sustainable future.

What if this is the catalyst we need to rethink the entire concept of homeownership? What if we could use technology to streamline the mortgage process, making it faster, cheaper, and more transparent? What if we could create new financial instruments that allow people to invest in their communities while also building equity? What if we could leverage the power of collective ownership to make housing more affordable for everyone?

The possibilities are endless, and frankly, they excite me.

Of course, we need to be mindful of the ethical implications. As mortgage rates become more accessible, we need to ensure that people are not taking on debt they can't afford. We need to protect vulnerable communities from predatory lending practices. We need to ensure that everyone has access to the resources and education they need to make informed decisions about their financial future.

But I am confident that we can navigate these challenges if we approach them with a spirit of innovation, collaboration, and compassion.

I saw a comment on a Reddit thread the other day that really stuck with me: "Lower rates aren't just about saving money; they're about opening doors." That's it, isn't it? It's about opening doors to new possibilities, to new dreams, to a brighter future.

Time to Build That Future, Together!

So, yes, mortgage rates are down a little. But don't just see it as a fleeting moment. See it as a launchpad, a foundation, a sign that we're moving in the right direction. See it as an opportunity to build a better world, one home at a time.